Search

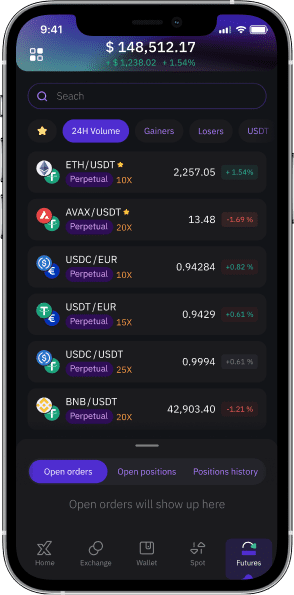

Match market volatility with Futures

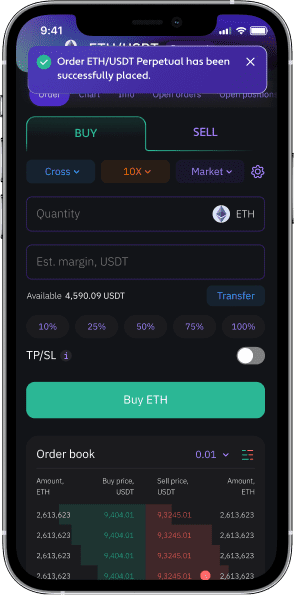

Unlock a unique opportunity to use both bearish and bullish market shifts in your trading strategy.

![XBO.com - Image]() Understanding

Understanding

Futures

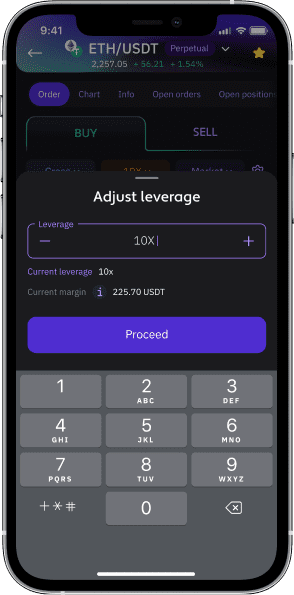

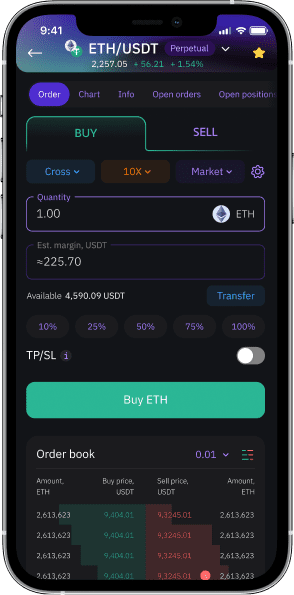

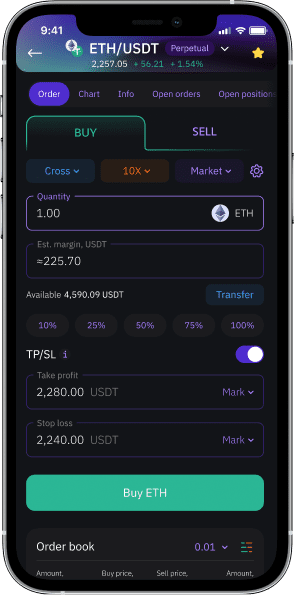

Futures are contractual agreements designed for the purchase or sale of an underlying asset at a predetermined price and a specific future date. These agreements derive their value from the assets they represent, and upon expiration, the trade is resolved through cash settlement. Importantly, traders engaging in Futures contracts are not required to possess the actual underlying asset.

The dynamic nature of Futures trading empowers market participants to capitalize on price surges by going long or profit from downturns by going short. This flexibility proves particularly beneficial in navigating the often volatile landscape of the cryptocurrency market.

The material presented in this website are for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake or hold any cryptoasset or to engage in any specific trading strategy. The volatile and unpredictable nature of the crypto-asset markets can lead to loss of funds. Geographic restrictions may also apply. This information is not directed or intended for distribution to or use by residents of certain countries/jurisdictions, including, but not limited to USA, China, Iran, Russia and more, since the Company does not offer its services to any of these jurisdictions.

Digital assets are complex instruments and involve high risk. Please ensure that you fully understand the risks involved before entering into any transactions.

Contact us: [email protected]

PROCRYPTIC SP. Z O.O., registered address at Mennica Legacy Tower, Prosta 20, 00-850 Warsaw, Poland.CLICKJOINT B.V., registered address at Zuikertuintjeweg Z/N (Zulkertuin Tower) Curacao.