DeFi Service Frax Finance Gains Momentum Amid Ether Staking Narrative, FXS in Focus

Decentralized finance (DeFi) application Frax Finance is briskly gaining favor among investors for its strong product suite as liquid staking derivatives (LSD) heat up ahead of Ethereum's impending Shanghai upgrade.

The Frax protocol is a two-token system comprising the FRAX stablecoin and a governance token, Frax shares (FXS). FRAX maintains a peg to the U.S. dollar by being partially collateralized by USD coin (USDC) alongside periodic buying and selling of FXS to maintain its market capitalization.

Frax's staked ether product launched in October is attracting capital. Users deposit ether (ETH) and receive the Frax ether token (frxETH), which is backed 1:1 with ether. This frxETH token can be freely traded or staked on other DeFi applications or on Curve’s liquidity pools – where stakers are currently earning up to 10% annualized.

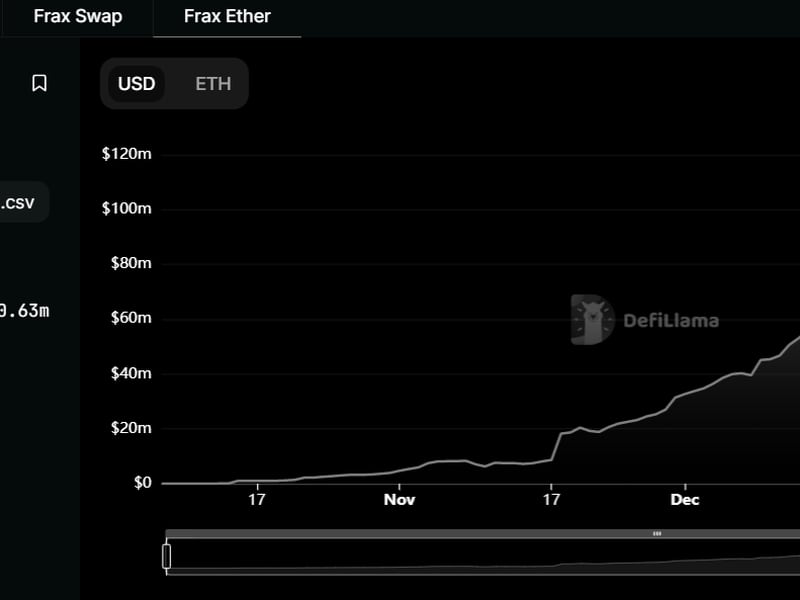

At writing time Tuesday, FrxETH holds just above $100 million, data from DeFiLlama shows. This is a nearly $50 million bump since the start of January, and nearly four times since November.

Frax is currently offering annualized returns of over 6% to 10% to users that stake ether on the platform. These rewards are paid out in CRV, FRAX and FXS, depending on the liquidity pool a user stakes their tokens.

In contrast, Lido, the biggest DeFi application by TVL, offers 5.2% yields to users.

The draw of capital into Frax’s ether pools has resulted in demand for FRAX and FXS tokens, with prices of the latter rising over 62% in the past week as per CoinGecko. And because some liquidity pools pay out in FXS, the price rise theoretically means higher rewards for stakers – which, in turn, could drive more ether towards Frax, and drive even more demand for Frax’s tokens among users.

Per some observers, Frax’s treasury holdings of Curve and Convex tokens are driving outsized returns for some stakers.

“FRAX has an advantage over other LSD platforms at the moment due to their outsized CRV/CVX treasury holdings,” said Hal Press, partner at crypto fund North Rock in a tweet this week. “This allows them to stimulate higher ETH staking yield on their staked ETH derivative product than the rest of the market.”

“Sentiment among traders increased amid increased utility for FXS tokens. These tokens accrue value from the newly minted FRAX stablecoins and fees from Frax Finance,” Press added, referring to bullish sentiment.

The summary of the FXS thesis is as follows. FRAX has an advantage over other LSD platforms at the moment due to their outsized CRV/CVX treasury holdings. This allows them to stimulate higher ETH staking yield on their staked ETH derivative product than the rest of the market. https://t.co/ODdkHjxq1O

— Hal Press (@NorthRockLP) January 17, 2023

Understanding Curve

It’s imperative to know how Curve works to fully understand the reason behind the high yields on Frax.

Curve offers a highly efficient way to exchange stablecoins while maintaining low fees and low slippage, according to documents from Curve Finance. Pools currently deployed on Curve are backed by centralized or decentralized stablecoins, wrapped tokens – such as wrapped bitcoin – or a basket of various assets.

Depositors on Curve earn annual yields of up to 4% from one of the many pools on the platform.

High trading volumes on liquidity pools on Curve that involve Frax contributes towards the FRAX token holding their intended dollar peg. Additionally, Curve allocates CRV tokens as rewards for liquidity providers to select pools, called gauge rewards, which results in more returns for liquidity providers.

“The long-term effect of the Curve AMO is that Frax could become a large governance participant in Curve itself,” as per Frax’s technical documents. Curve holds over $6 billion in tokens as of Tuesday and is among the few “blue-chip” DeFi protocols.

A cumulation of the above means Frax is currently offering annualized returns of over 6% to 10% to users that stake ether on the platform. These rewards are paid out in CRV, FRAX and FXS, depending on the liquidity pool a user stakes their tokens in.

In contrast, Lido, the biggest DeFi application by TVL, offers 5.2% yields to users.