Curve DAO Proposal to Enable Easier CRV Rewards Passes With Overwhelming Support

A proposal to enable rewards originating from stablecoin swap application Curve on third-party applications passed with overwhelming support from the community earlier today, results of the poll from Curve’s governance forums show.

Depositors on Curve earn up to 4% annual yields from one of the many pools on the platform. Curve is the third-largest decentralized finance (DeFi) project with over $5.8 billion in value locked. Its CRV are issued as yield farming rewards to liquidity providers on Curve Finance, and can be converted into vote-escrowed CRV (veCRV). Holding veCRV allows users to participate in platform governance, earn higher rewards and fees and receive airdrops.

An on-chain governance proposal floated last week sought to end other projects by undertaking several steps before offering and managing CRV rewards to their users. Projects would previously have had to either float their own governance proposals or use the assistance of a core Curve team member to offer CRV rewards to users.

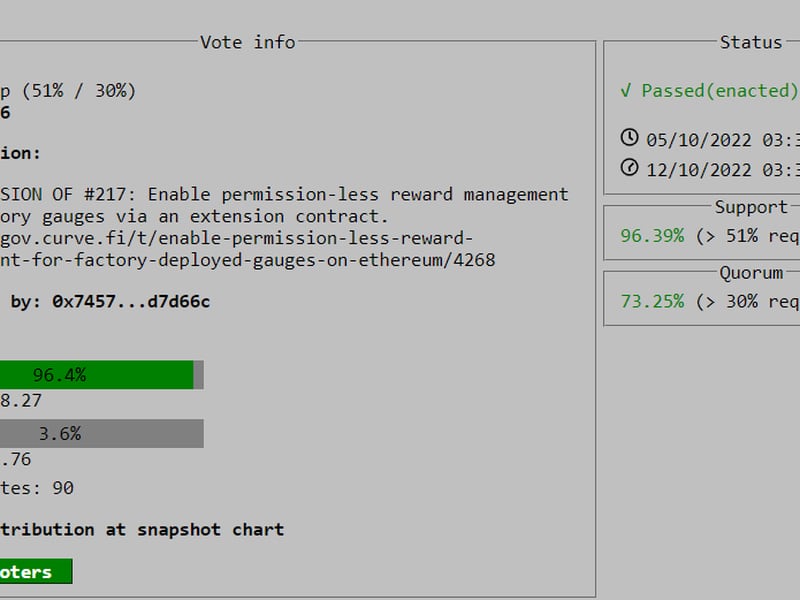

Over 96% of all votes agreed with the proposal with some 327 million CRV staked. Just 3.6% voted no. The deployment would massively reduce the time required to deploy and manage CRV rewards to third-party applications.

“The contract will enable gauge creators to bypass both and manage gauge rewards themselves,” the Curve proposal read. Gauges on Curve measure how much a user provides in liquidity based on which they receive CRV or other tokens in rewards.

The allocation of CRV among the various gauges is dictated by veCRV holders through a weekly vote. These holders would still determine how much rewards are distributed to Curve guage holders via a governance vote.

Curve core team member skellet0r said the ability to add a rewards gauge without permission was a highly demanded feature from Curve’s users.

“Requests for assistance to add rewards to factory gauges has been very consistent,” skellet0r wrote on governance forums.

“The extension was written because the Liquidity team wanted a seamless/painless/trustless way to deploy their gauge and then instantly add rewards during their deployment,” they further explained, pointing out the problem this deployment solved was that of the lengthy time required between proposing and enabling gauge rewards.