Is the Sam Bankman-Fried Story Over?

Last month, I attended Sam Bankman-Fried's sentencing hearing. Not that anyone asked, but I have some thoughts.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

25 Years

Former crypto king Sam Bankman-Fried was sentenced to 25 years in prison last month. Just like during last year's trial, CoinDesk journalists were in attendance.

The sentencing hearing took 1 hour and 59 minutes. In that time, we heard from Judge Lewis Kaplan, defense attorney Marc Mukasey, Assistant U.S. Attorney Nicholas Roos, an FTX creditor, an attorney representing other FTX creditors and Bankman-Fried himself. In some respects, the hearing was a final chance for everyone – the judge exorcized some demons in summing up who he thought Bankman-Fried was, the prosecutor dropped a final nail into Bankman-Fried's coffin and the former CEO whiffed his last chance to define himself in court.

The hearing's brevity perhaps belied its significance. The judge presiding over the case first worked through various objections the defense had to sentencing guidelines recommendations made in the Presentence Investigation Report, disagreeing with the defense's objections to how the crimes Bankman-Fried was convicted of were characterized and landing at a baseline sentence of 110 years.

Sunil Kavuri, a vocal FTX creditor, and FTX creditor group attorney Adam Moskowitz both spoke. Kavuri pushed back against the defense argument that creditors haven't suffered any real losses because they'll get their money back, but mostly directed his ire at the current bankruptcy team (prompting the judge to interrupt him twice). Moskowitz spoke of the cooperation he received from FTX insiders in trying to secure funds for creditors, including "Sam and his team," asking the judge to keep that under consideration.

New defense counsel Mukasey said Bankman-Fried was a "beautiful puzzle" who didn't intend to harm anyone and was not malicious. Roos repeated the closing statement he made at trial, saying Bankman-Fried stole funds – and even if he didn't spend it on cars, that doesn't mean he wasn't greedy.

Bankman-Fried spoke. A defense attorney I spoke to before the hearing said it would be a bad idea for him to say anything. The consensus among observers after the hearing was that Bankman-Fried didn't really help his case. He said FTX's customers are who matter, shouted out many of his former colleagues and their efforts and said his management led to FTX's 2022 bankruptcy before veering off-topic, blaming the bankruptcy estate for the fact creditors haven't received refunds yet.

"I made a series of bad decisions," he said. "They weren't selfish decisions. They weren't selfless decisions. They were bad decisions. And those culminated with a bunch of other factors along with the liquidity crisis for Alameda in November of 2018. It wasn't bankrupt. FTX wasn't bankrupt. Alameda wasn't bankrupt. There were no losses to socialize to customers."

"My useful life is probably over," he said at one point.

He reiterated his previous stance that customers "could have been paid back," saying there are currently enough assets – and have been – to repay customers in full. And again, he hinted that current FTX CEO John J. Ray III and the bankrupt exchange's cleanup crew were doing something wrong.

"This isn't the time or place to tell that full story for why they are still waiting, for why they are not sure if they are going to get petition-date value or current values," he said. "But a good place to start with is Dan Friedberg's affidavit that he filed a bit over a year ago in bankruptcy court. It was a brief affidavit. I don't think he made a lot of friends for filing that. I suspect he made some enemies."

He closed by saying there was "an opportunity" for his former colleagues or someone "to do what the world thought I would do."

AUSA Roos pointed to this in his own statement, arguing Bankman-Fried hadn't accepted responsibility for the collapse of FTX, just that he seemed to say things could have worked out differently if he hadn't made the mistakes he'd made.

And finally, it was the judge's turn again.

Over the past few months of watching Judge Kaplan during pretrial hearings and the trial itself, I've come to appreciate just how on top of this case he has been. He's got a busy docket – one of his other cases features a former U.S. president as a party, for example – but he has been a colorful figure when addressing Bankman-Fried's trial details.

This is a judge who seems to recognize that he's going to be quoted in press reports and filings for quite some time to come. His actions during the entire case will certainly be scrutinized when Bankman-Fried's appeals last year's guilty verdict.

"I reject entirely the defendant's argument that there was no actual loss," he said at the outset of the hearing. "The defendant's assertion that FTX customers and creditors will be paid in full is misleading, it is logically flawed, it is speculative."

It's no secret that the judge appears to have a dim view of Bankman-Fried. He was all but openly derisive toward the former crypto mogul when Bankman-Fried testified during the trial itself, to the point where I did genuinely wonder how the jury perceived his comments about the defendant on the stand. Eighteen random members of the public, who had no little or no familiarity with FTX, crypto, Bankman-Fried or being on a jury, may well have easily taken cues from the most visible legal expert who ran the show. Judge Kaplan sent the jury out for some part of his "what are you all doing?" lectures but he couldn't or didn't hide his disdain for the defendant all the time.

Of course, Sam did not help his case much. Despite the polished responses he provided his own counsel, he floundered against the slightest pushback during cross-examination, as my colleagues and I noted last year.

Judge Kaplan, when he spoke during the sentencing hearing, had an air of a man finally able to unleash the full force of his disdain. He cited three specific examples of when he believed Bankman-Fried committed perjury on the stand, and didn't just rely on a general idea that he perjured himself simply by pleading not guilty and being convicted.

"I did not think it a fruitful use of time to spell out every time I thought Mr. Bankman-Fried testified willfully and knowingly falsely at trial. There are more than the ones I've articulated, but that suffices," the judge said. "And when he wasn't outright lying, he was often evasive, hairsplitting, dodging questions and trying to get the prosecutor to reword questions in ways that he could answer in ways he thought less harmful than a truthful answer to the question that was posed would have been."

It's a harsh, but accurate assessment of Bankman-Fried's performance on the stand. His performance, as the judge put it, was awful. I'm somewhat sympathetic to the idea that being in jail made it difficult for Bankman-Fried to properly prepare for cross-examination, but he seemed to resent his narrative being questioned during his testimony and it undoubtably made an impression on the jury, witnesses and the judge.

More than that, Bankman-Fried didn't quite seem to grasp how his demeanor and responses were received by the judge and jury. This was true last year and remained true last month.

"I've been doing this job for close to 30 years," the judge said. "I've never seen a performance quite like that."

A friend asked me what I thought of the sentence after it was handed down. I don't know yet. I agree with AUSA Roos, who told the jury – and later, the judge – Bankman-Fried lied during the course of FTX's life.

"He spent his customers' money and he lied to them about it. Where did the money go? The money went to pay for investments, to repay loans, to cover expenses, to purchase property, and to make political donations," Roos said last year. During the sentencing hearing, he went further, saying, "the fact that Mr. Bankman-Fried spent the money on investments, rather than sports cars, or whatever you might expect for someone classically greedy, does not make him not greedy or does not express a motive of greed. The fact that he had ambitions that seem altruistic does not make him not ambitious, is not a motive for doing these things."

In other words, Bankman-Fried may genuinely believe that using his companies' funds for pandemic preparedness and other purposes was for the net benefit of humanity, but it doesn't mean he didn't use customer funds or lie about it.

Does that warrant 25 years in prison? Perhaps. But I also want to touch on something I wrote when he was first convicted – 25 years is a long time. The world moves quickly, more quickly than we can immediately appreciate in our day-to-day lives. This time 25 years ago, people used pagers and car phones were just finally dropping out of popularity. Steve Jobs was years away from sparking the smartphone revolution, GeoCities was an exciting Yahoo! product and Pokémon was just three years in.

Bankman-Fried's new legal team is going to appeal. We've known he would appeal since the start of his trial. There'll be a hearing, and it's anyone's guess how the appeals court may rule. But from my view as a reporter, it'll be a long shot for his team.

We're closing this chapter on Bankman-Fried, though as we've seen, jail won't stop him from sharing his views and so the book remains open.

Stories you may have missed

- New York Jury Finds Do Kwon, Terraform Labs Liable for Fraud in SEC Case: A group of jurors found that Terraform Labs and Do Kwon were liable for civil fraud charges brought by the U.S. Securities and Exchange Commission, which alleged Terraform and Kwon misled investors about Terra USD's stability. Cheyenne Ligon provides some more background here.

- Key Congressman McHenry Is Bullish U.S. Stablecoin Law Will Pass This Year: House Financial Services Committee Chairman Patrick McHenry (R-N.C.) still believes stablecoin legislation has a shot at becoming law before he leaves Congress in January.

- Detained Binance Exec Pleads Not Guilty to Money Laundering Charges in Nigeria: Reports: Binance head of financial crime compliance Tigran Gambaryan – a U.S. citizen who was detained without being charged for weeks – has now been charged with tax evasion and money laundering by Nigeria, as the country's crusade against Binance continues.

This week

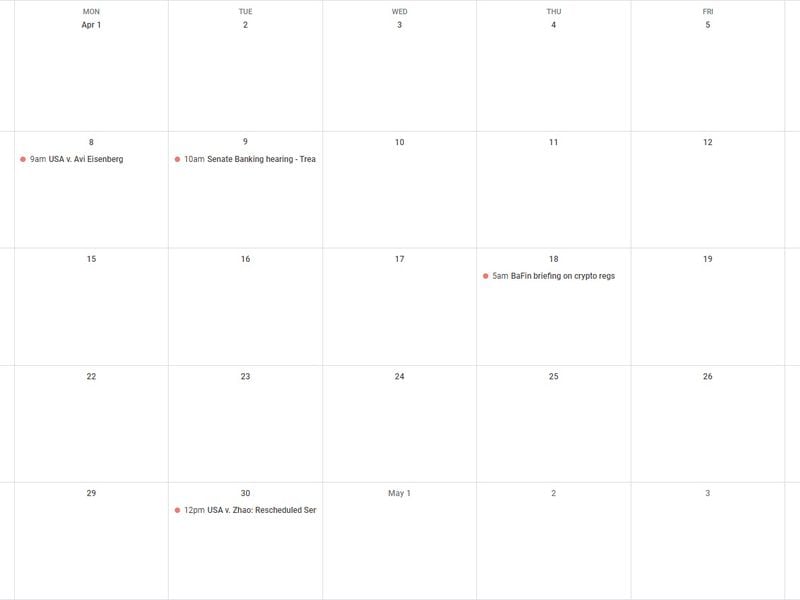

Monday

- 13:00 UTC (9:00 a.m. ET) USA v. Avi Eisenberg, i.e. the Mango Markets trader who drained its holdings through a specific arbitrage trade, began. Read Danny Nelson's coverage here and here.

Tuesday

- 14:00 UTC (10:00 a.m. ET) The Senate Banking Committee held a hearing on illicit finance.

Elsewhere:

- (Bloomberg) For a while there, Hertz was bankrupt. Then some folks brought it out of bankruptcy. Things appear to have gone downhill from there, according to this Bloomberg report.

- (The Wall Street Journal) The Journal reported on the role of USDT as a tool smugglers use to bypass U.S. sanctions.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!