Short-Term Holders Send $3B in Bitcoin to Exchanges at a Loss as Mideast Tensions Rise

- Bitcoin recorded back-to-back daily declines of 3.7% as tensions in the Middle East escalated.

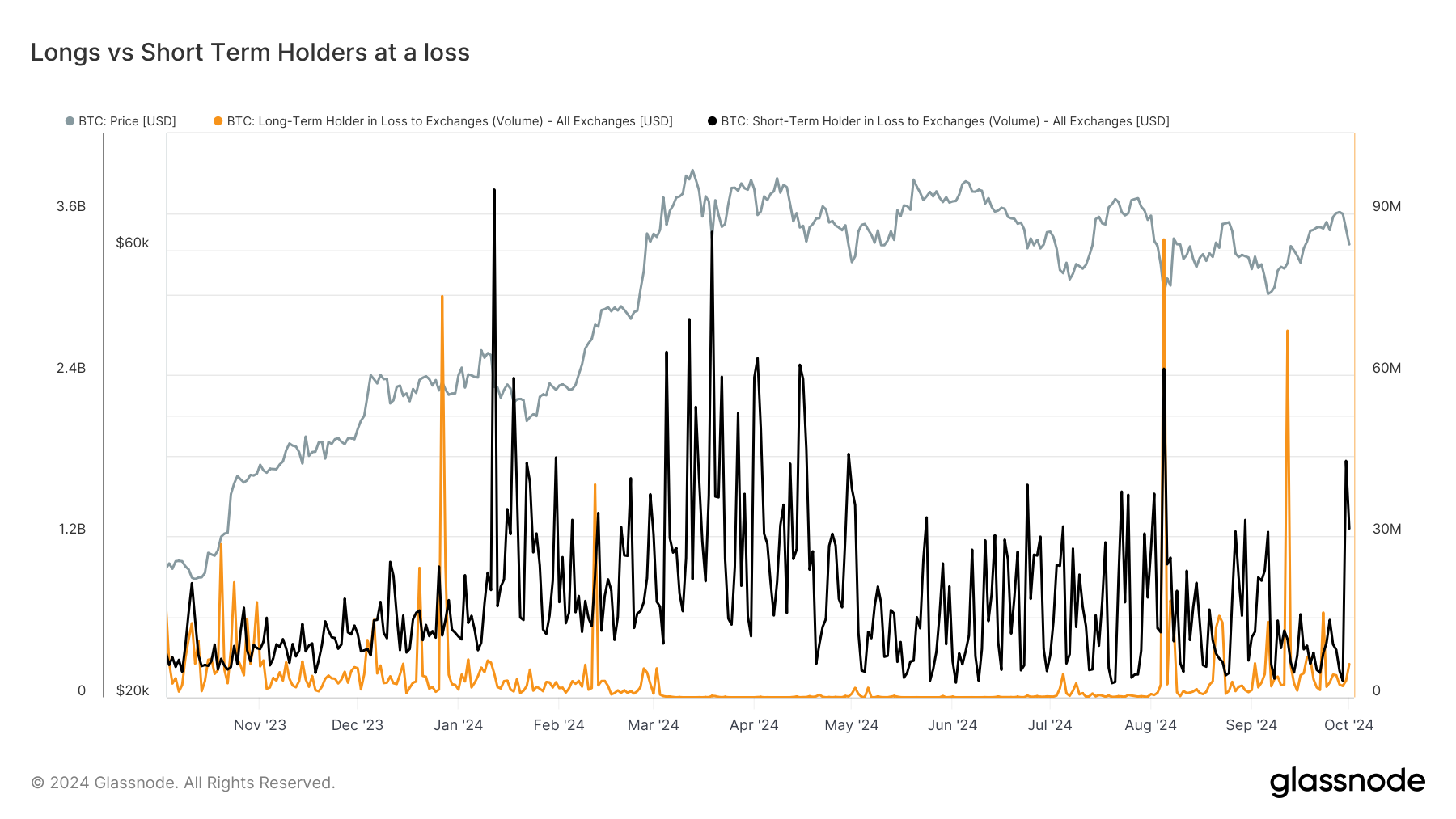

- Short-term holders sent $3 billion worth of bitcoin to exchanges at a loss over the past two days.

In the past two days, Sept. 30-Oct. 1, bitcoin {{BTC}} registered consecutive declines of 3.7% as geopolitical tensions ramped up in the Middle East, culminating in Iran's 200 ballistic- missile attack on Israel on Tuesday.

With the largest cryptocurrency little changed on Wednesday, this year marks the worst-ever start to an October, a month that's historically provided positive returns.

One headwind comes from so-called short-term holders, which Glassnode defines as investors who have held bitcoin for less than 155 days. This is a group that tends to panic-sell when the BTC price drops below their cost basis. Glassnode data shows this cohort has bought roughly 100,000 bitcoin since Sept. 19, when bitcoin was trading at $62,000.

By Sept. 27, bitcoin had surged to above $66,000, and, as the chart shows, this group was buying aggressively as the price increased. However, they started dumping their holdings as the price started to fall.

In the past two days, short-term holders have sent roughly 64,000 bitcoin to exchanges, the equivalent of $4 billion. Of that, some $3 billion was sent at a loss, meaning it was sent when the price was lower than the entity's average on-chain acquisition price.

This is the highest amount of loss sent to exchanges by the group since Aug. 5, during the yen carry trade unwind, which saw $2.5 billion of losses sent in one day.

Long-term holders, on the other hand, seem to be holding their nerve. As a group, they sent just 100 bitcoin at a loss to exchanges over the same time frame.