Shiba Inu-Themed BONK Tokens Are Yielding Nearly 1,000% for Solana Liquidity Providers

A flat market and ongoing contagion risks aren’t deterring crypto traders from finding the next major narrative to generate returns, and a memecoin is at the center of that in the Solana (SOL) ecosystem.

Bonk, a Shiba Inu-themed token issued on Dec. 25, has returned some 2,220% to traders in the past week, with a 150% rise in the past 24 hours alone. The token was airdropped to Solana NFT communities and creators which led to quick hype and trading volumes for the young token, as CoinDesk reported Tuesday.

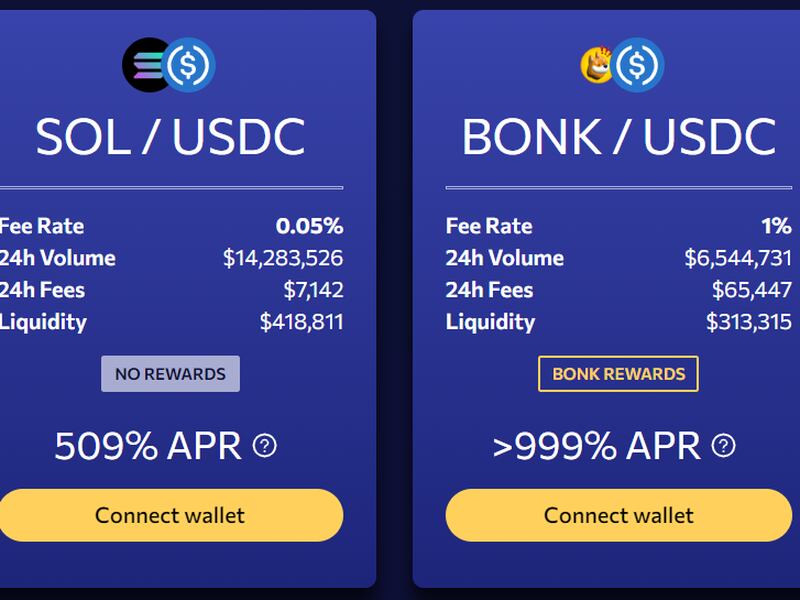

Early investors aren’t the only ones gaining, however. Liquidity pools on Solana-based decentralized exchanges (DEX) such as Orca have attracted over $20 million in volume for trading pairs involving BONK – cumulatively netting thousands of dollars in fees for liquidity providers.

Liquidity providers are investors who stake their cryptocurrency tokens on DEXs to earn transaction fees, usually in the form of token rewards.

Data from Orca shows the BONK/SOL pair has conducted over $14 million in trading volume, while the BONK/USD Coin pair saw over $6.2 million. Both pools are paying out nearly 1% hourly to liquidity providers, or over 24% each day.

The metrics made bonk the most traded token on Orca, a popular Solana DEX, with trading volumes higher than even solana, usually the most popular trading pair with USDC.

As such, the yields are likely to be short-lived if demand, and hype, for BONK slow down in the coming weeks and traders take profits.

Despite being fashioned as a memecoin, Bonk tokens are seeing steady adoption in the Solana ecosystem. Several Solana projects have already integrated bonk tokens for use as payments for listed NFTs, while some introduced “burn” mechanisms for NFT-based events. Over 1 billion BONK was burned in the past 24 hours, as per tweets.

Meanwhile, the interest around bonk has likely contributed to the demand for SOL tokens. Prices are up 16% in the past 24 hours, erasing losses from a steep decline last week.