First Mover Americas: Ether Declines 7% Post-Merge and Makes Ether Futures More Sensitive to Staking Yields

- Price Point: Ether falls 7% after the Ethereum blockchain successfully completed its Merge Thursday. Chainlink's LINK and Chiliz's CHZ both make gains on the day following new announcements.

- Market Moves: The Merge has made the ether futures market more sensitive to staking yields and could theoretically keep the futures curve in "backwardation."

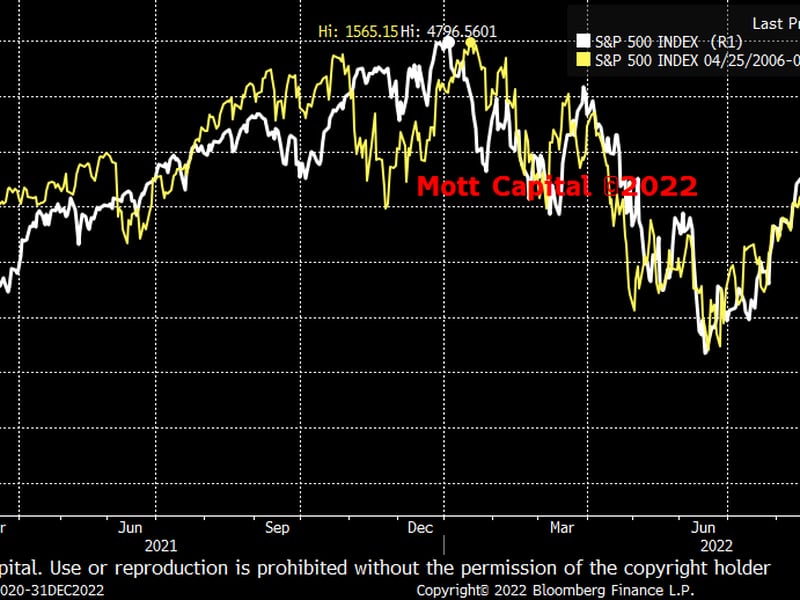

- Chart of the Day: S&P 500 follows 2008 analog in a bad sign for crypto.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price Point

Ether was trading down 7% over the last 24 hours after the Merge, a software update where the Ethereum blockchain successfully moved its consensus mechanism to proof-of-stake from proof-of-work. Following the Merge, the cryptocurrency briefly spiked 3% and then resumed its downtrend.

“It seems likely that a mix between the still-high correlations and investors looking to 'sell the news' led to ether's severe drop in spite of the milestone accomplished,” IntoTheBlock wrote in a research note Friday.

David Scheuermann, a trader at Crypto Finance AG’s, said it will take time to see the full effect of the Merge on the price of ether and the consequences should prevail once we are “out of this bear market.”

Ethereum classic was also trading down 10% on the day, and bitcoin, the world’s largest cryptocurrency, was down by 2%.

Chainlink’s LINK token climbed 5% after the project announced it is collaborating with engagement platform, bountyblok. It integrated Chainlink Verifiable Random Function (VRF) into Chainlink’s giveaway and distribution tools on Polygon’s mainnet to replace its previous centralized randomizer service (random.org).

Bountyblok tweeted, “This allows for provably fair and tamper-proof distributions and drawing of winners.”

Chilliz (CHZ), the token that powers socios.com, a blockchain-based fan and rewards platform, was up 10% after Chilliz tweeted Thursday that it will introduce a fan token made in Brazil on its launchpad.

In traditional markets, futures for the S&P 500 were down 0.9%. Contracts for the tech-focused Nasdaq 100 were 1% lower.

In the news, Celsius Network, which is in Chapter 11 bankruptcy proceedings, has asked for authorization to sell its stablecoin holdings in order to generate liquidity to help fund its operations, according to new court filings.

And exchange giant FTX is in the lead to buy the assets of Voyager Digital, the cryptocurrency lender whose bankruptcy filing deepened this year’s industry crisis, but higher offers could still come in the days ahead, according to a person familiar with the matter.

CoinDesk Market Index

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| WAX | WAXP | +10.84% | Culture & Entertainment |

| Chiliz | CHZ | +6.42% | Culture & Entertainment |

| Biconomy | BICO | +6.15% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Render Token | RNDR | -14.5% | Computing |

| Celsius | CEL | -9.34% | Currency |

| Polymath | POLY | -9.2% | DeFi |

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure the market capitalization weighted performance of the digital asset market subject to minimum trading and exchange eligibility requirements.

Market Moves

Ethereum Merge Has Tied Ether Futures Activity to Staking Yields, Traders Say

By Omkar Godbole

The Ethereum Merge, which happened on Thursday, has introduced several structural changes to the blockchain, promising to make it more environmentally friendly and reduce the supply of its native token ether (ETH).

According to traders, one consequence of the upgrade is that the activity in the futures market will now be closely tied to staking yields – rewards earned by locking ETH in the network in return for a chance to verify transactions under the proof-of-stake (PoS) consensus mechanism.

The bigger the reward for staking, the greater the number of stakers and the stronger the demand for shorting or selling futures. That's because staked ether cannot be withdrawn before the next upgrade called Shanghai fork, due in mid-2023, and will earn rewards in ETH, which makes stakers vulnerable to potential ether price slides. Therefore, they will likely hedge their ETH exposure by selling futures contracts tied to ether.

"Stakers have been and will be natural sellers in futures and perpetual futures. That's why open interest [number of open positions] is so high, and it will only grow if staking yields go higher," Zaheer Ebtikar, portfolio manager at crypto hedge fund LedgerPrime, told CoinDesk.

Ethereum's network switched to the PoS system on Thursday after the PoS Beacon Chain launched in December 2020 merged with the Ethereum mainnet that used a proof-of-work (PoW) mechanism whereby miners solved algorithmic problems to validate transactions in return for rewards. In other words, stakers are new validators.

While the Merge has taken away substantial miner selling from the spot market, it could bring more sellers to the futures market and cap the basis or the difference between prices in futures and spot markets or perhaps push futures into backwardation.

Read the full story here.

Chart of The Day

Bitcoin's Mean Net Inflows Surge to a Six-Year High

By Omkar Godbole

- Stocks may be heading to new lows, as the chart provided by Mott Capital Management's Michael Kramer shows the S&P 500, Wall Street's benchmark index, is closely tracking the 2008 bear market slide.

- Cryptocurrencies tend to move in line with stocks and could challenge June lows if S&P 500 keeps tracking the 2008 analog.

Latest Headlines

- SEC's Crypto Guidance Pushes US Banks to Rethink Custody Projects, Reuters Reports:The regulator suggests that customers' crypto assets should be treated as liabilities by lenders, which could be "prohibitively costly" for banks.

- Ethereum PoW Network Sees Complaints on Day 1 Amid Data Goof-Up: Users said they weren't able to access the blockchain's servers using the public information and attempts to link it to a crypto wallet failed.

- El Salvador's Debt Rating Cut to CC at Fitch: The rating agency said the country is likely to default on a January debt repayment because it has limited market access to raise the funds needed, in part because of its bitcoin adoption.

- Biden’s Executive Order Produces Few Answers in Crypto Reports From US Treasury: After six months, the federal government’s review of the crypto world hasn’t yet offered a road map for oversight, though it hinted at a federal regulatory structure and emphasized that a central bank digital currency may have serious support.