Derivative Volumes of Ether Surpass Bitcoin Ahead of Merge, Here's Why

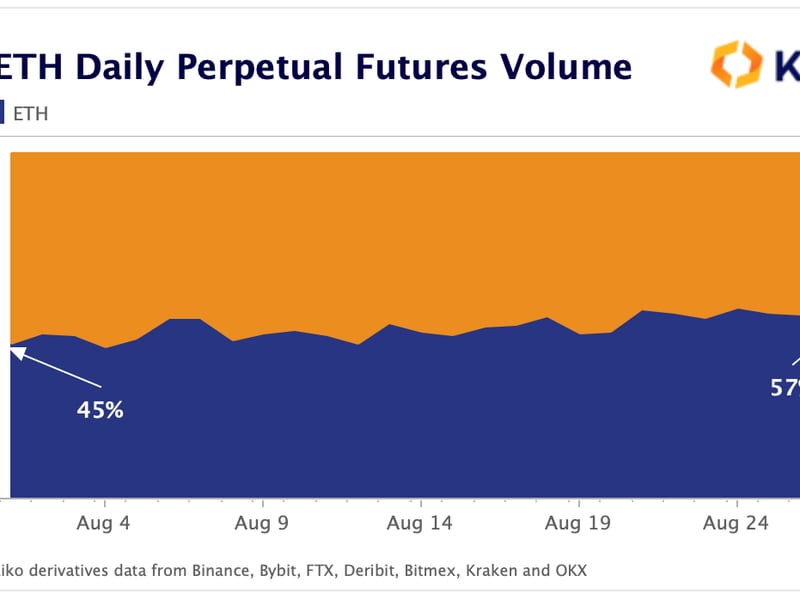

Volumes of derivatives tracking ether (ETH) have grown nearly 10% in the past month and now lead those of bitcoin (BTC), according to a report from Kaiko, citing data sourced from multiple crypto exchanges.

Out of the total addressable market of ether and bitcoin futures, ether now commands 57% compared to 45% on Aug. 1. Open interest – or the number of unsettled futures contracts – has ballooned to over $8.43 billion this week from under $4 billion in July, data shows. This suggests that in the past few weeks, ether prices have been pushed upwards due to the high use of leverage.

Futures data from the past 24 hours shows ether futures crossed over $35 billion in total volume compared to $32 billion on bitcoin futures, which usually see the highest volumes.

The interest in ether futures likely arises from traders positioning themselves ahead of Ethereum’s Merge scheduled for later this month – a catalyst that has changed market dynamics for ether and caused price fluctuations.

Funding rates data suggests a significant part of that open interest could be from short trades, or positions that bet against price rises. Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets.

Depending on their open positions, traders will either pay or receive funding, and the payments ensure there are always participants on both sides of the trade.

As per Kaiko analyst Conor Ryder, such short trades are growing in popularity as investors are either betting on an unsuccessful or delayed transition to proof of stake, or hedging their long spot ether positions ahead of The Merge. The latter reason is increasingly becoming a favored bet among investors, Ryder said, as some anticipate the possibility of an Ethereum fork and an eventual airdrop of a new ETHPOW token.

“A strategy also doing the rounds involving short ETH futures has been to go long spot ETH, short futures and leave yourself eligible for any ETHPOW airdrop,” Ryder wrote. “Think of this as a dividend strategy, eliminating any price risk by going long spot, short futures, but collecting a potential dividend in ETHPOW.”

Future markets for ETHPOW have pegged prices of the potential token at $18, or just 1.5% of ether’s current value, as reported.

The Merge shifts Ethereum from a proof-of-work mechanism to a proof-of-stake design, after which the network will rely on “stakers” to process transactions instead of miners. This would theoretically increase network speed and security, while considerably reducing the power requirements needed to run the current Ethereum blockchain.

The event is additionally expected to slow the rate at which ether is issued – particularly in the months immediately following the switch. As issuance slows, the blockchain’s token-burning mechanism will continue removing ether from circulation at the same rate as before the Merge.

Over time, this could decrease ether’s total market supply and eventually cause an increase in prices with increasing demand. However, some traders remain skeptical about the medium-term price performance of ether.

Ether trades at just under $1,600 at writing time and has risen 3% in the past 24 hours, data shows.