Crypto Traders Worried About Continued Liquidity Thinning in Bitcoin and Ether

Liquidity conditions in the bitcoin (BTC) and ether (ETH) markets continue to worsen and the situation is now more alarming than it was three months ago. That has traders worried about abrupt price swings in the crypto market.

Liquidity refers to the ability of the market to absorb large buy and sell orders at stable prices. The commonly used metric for assessing liquidity conditions is 2% of market depth – a collection of buy and sell offers within 2% of the mid-price or the average of the bid and the ask/offer prices.

More significant the depth, the more liquid an asset is said to be, and vice versa.

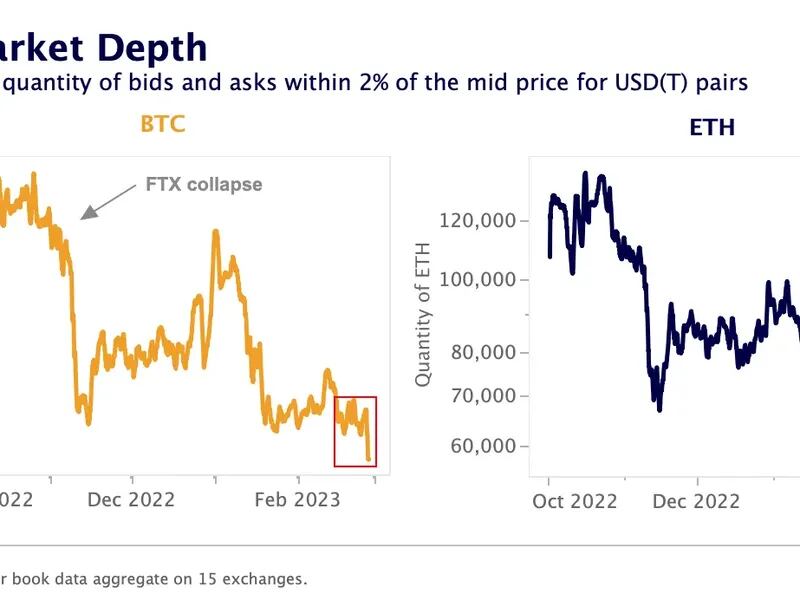

Data from Paris-based crypto data provider Kaiko show bitcoin's 2% market depth for USDT pairs aggregated from 15 centralized exchanges has slipped to 6,800 BTC, the lowest since May 2022, surpassing the post-FTX low. That's significantly down from the October highs above 15,000 BTC. Ether's 2% market depth has more than halved to 57,000 ETH since October, led by Binance.

"Thin liquidity means more drastic moves, particularly in alternative cryptocurrencies," Matthew Dibb, chief investment officer at Astronaut Capital, said.

"Funds trying to trade size are forced to TWAP over longer periods (days or weeks) hence why it looks like some charts have recently been 'walked up' such as STX," Dibb added.

TWAP, or time-weighted average price, is a well-known algorithmic strategy focused on achieving an average trade execution price close to the time-weighted average price of the asset. In other words, it involves breaking a large order into smaller quantities and executing those at regular intervals to minimize the impact on the going market and reduce slippage.

Slippage is the difference between the expected price at which a trade is placed and the actual price at which the buy/sell transaction is executed. Slippage usually occurs when there is low market liquidity or high volatility.

"Realistically though, dwindling market depth has also meant that most large funds have not been participating at the same level as previous due to the amount of slippage associated," Dibb noted, adding that any large institution that offloads coins now is going to have a deeper effect on the market.

The latest decline in the market depth comes amid dwindling volatility expectations in the bitcoin market. This type of situation often leads to sudden volatility explosion, according to Griffin Ardern, a trader from crypto asset management firm Blofin.

The Bitcoin Volatility Index (BVIN), which measures the implied or expected volatility over the next 30 days, has declined to 56.39, the lowest since at least early 2021, according to data source CryptoCompare.

Bitcoin's seven-day variance risk premium, or the difference between the seven-day implied volatility and seven-day realized volatility, has flipped negative, according to data tracked by Amberdata. It shows short-term volatility expectations are underpriced.

"An environment conducive to high volatility is being created," Ardern said. "And because the depth is low, it only takes a small amount [buy/sell order] to influence the price, and the resulting hedging activity of market makers to amplify market volatility through hedging."

Market makers always take the opposite side of investors' trades and maintain a market-neutral portfolio by buying and selling the underlying asset as the price swings. Their hedging activity is known to influence the bitcoin's spot market price and could have an outsized impact this time, thanks to low market depth.

The crypto market liquidity began drying in mid-November after Alameda Research and FTX went bust in November. Alameda was one of the most prominent market makers providing billions of dollars in liquidity to small and large-cap tokens. The resulting contagion brought down several trading desks, including Arbitrage and high-frequency trading firms, and hurt prominent market makers like Genesis.

"It's likely all the major market-makers were affected, to varying degrees, by the collapse of FTX. As a result, several liquidity providers have likely scaled back or even ceased their market-making activities as part of an overall effort to de-risk," Dick Lo, the founder and CEO of TDX Strategies, said.

"There's also been a migration of positions to decentralized exchanges to minimize counterparty risk, hence the growth in volumes at popular decentralized trading venues such as GMX," Lo added.