NFT Market Share Battle Ramps Up Between OpenSea and Blur

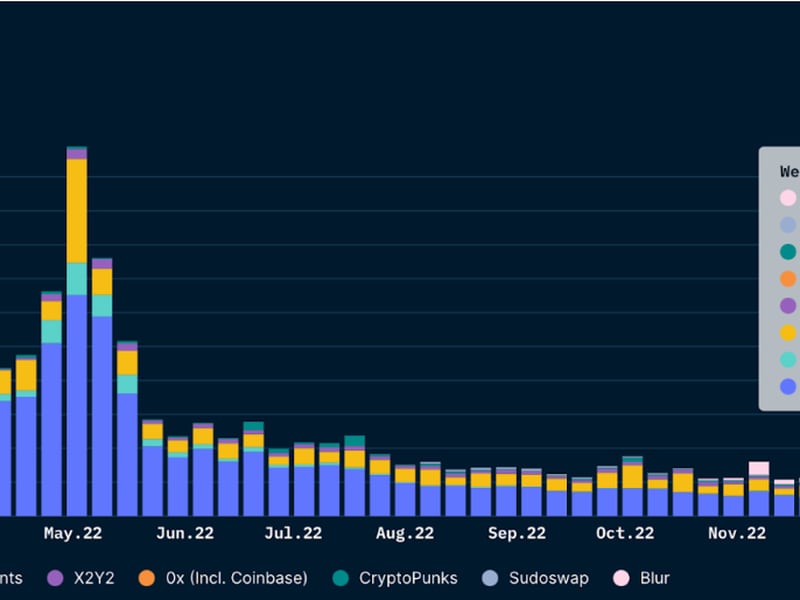

2023 has been marked with increasing competition in the non-fungible token (NFT) space as different marketplaces fight for creators and collectors.

OpenSea has been the frontrunner of the NFT marketplaces since its launch in December 2017. It continues to dominate the NFT scene: Last week it had over 34,000 ETH in trading volume worth some $56 million, according to . But competing marketplace Blur has gained considerable momentum among JPEG slingers since its debut in October.

Known for its zero trading fees and marketplace “floor sweeping,” Blur has climbed to become the second-largest NFT marketplace in just a couple of months by volume. For the week ending Feb. 6, Blur’s NFT volumes stood over 9,200 ETH worth some $15.2 million, representing more than 25% of OpenSea’s volume, according to blockchain analytics platform Nansen.

Market overview

OpenSea’s top five NFT projects by volume in the past 30 days include Sewer Pass, Memes by 6529, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC) and Checks – VV Edition.

In comparison, Blur’s top five NFT projects by volume in the past 30 days includes MAYC, Azuki, BoredApeKennelClub, BAYC and Otherdeed for Otherside, all high-volume collections.

While OpenSea and Blur have two overlapping NFT projects, namely BAYC and MAYC, the medium market cap for Blur’s top five is 270,109 ETH, while OpenSea’s medium market cap for its top five is 94,400 at time of press Tuesday. Blur having a higher medium market cap for its top five NFT collections suggests professional NFT traders are using Blur more often than OpenSea.

Nansen’s “Simian Psychometric Enhancement Technician” Andrew Thurman said to CoinDesk over Telegram, “Blur wins certain high-volume collections, like Apes and derivatives, and dominates with Azukis. OpenSea has broader reach with new collections and things like the Sewer Passes.”

Sales and wallets

Blur has attained more than 25% of OpenSea’s volume, and yet the number of NFT sales and wallets on Blur’s marketplace dwindles in comparison to OpenSea, indicating that NFT traders with large holdings prefer Blur’s no-fee marketplace more.

The number of sales on Blur for the week ending on Feb. 6 stood at 20,603, roughly 9% of OpenSea’s total number of sales, which sits around 228,000, according to Nansen data. And when looking at the number of wallets interacting with the two NFT marketplaces, a similar trend emerges: The number of wallets interacting with OpenSea is 11 times greater than those plugged into Blur, demonstrating how OpenSea dominates Blur.

“In aggregate, this tells me [OpenSea] is dominating with retail traders and volume still, but big-budget whales looking to flip more expensive pieces are taking their business to Blur,” Thurman told CoinDesk via Telegram.

Blur, after months of consistently airdropping its BLUR tokens to users for various levels of engagement, has said it would launch its BLUR governance token on Feb. 14.

An OpenSea spokesperson declined to comment, while Blur did not return a request to comment by press time.